Jeff Krumpelman, CFA

Chief Investment Strategist & Head of Equities, Mariner

It is possible to have too much of a good thing.”

– Greek storyteller Aesop

“Too much of a good thing can be wonderful.”

– Actress and comedian Mae West

A potential Santa Claus rally and post-election bounce that typically appears in the final two months of the calendar year got off to a nice start in November. The S&P 500 price surged 2.5% on November 6, the day after the presidential election, and, after a mid-month lull, went on to return a total of 5.9% for the month.1 Equity asset class and S&P 500 sector leadership exuded investor confidence as small-cap stocks outperformed large-cap stocks by a wide margin and the more offense-oriented/risk-on industry groups within the S&P 500 well outpaced the defensives. Specifically, the Russell 2000 index of small-cap stocks returned a total of nearly 11% in November versus the 6% advance of the large-cap-dominated S&P 500 index.2

Similarly, in examining returns of the various S&P 500 constituents, we see that the more risk-on sectors such as financials (+10%), consumer discretionary (+13%) and industrials (+7.5%) left the overall index and the poorer-performing defensive sectors such as consumer staples and utilities in the dust. Small-cap stocks have finally climbed to a new all-time high with the previous mark set back in November 20213 while the S&P 500 hit its 50th new high for the year. The latter has returned a total of more than 28% for the year and, as of this writing, stands at just above the 6,000 mark … essentially our base case target for mid-year 2025.4 Animal spirits, indeed!

TBD: The Election’s Impact on Financial Markets

For the moment, investors seem to be focused on the sugar and honey nature of the upcoming Trump administration’s tax cut and deregulatory policies to spur economic growth. At present, they are of the mind to ignore or defer concerns about the potential negative offsetting forces such as risk of rising inflation, tighter labor market conditions and rising deficits that could surface. These opposing gloom-ridden influences that would restrict growth represent the quite possible and less enjoyable impacts of aggressive tariff strategies, various deportation-related scenarios and fiscal policies under discussion.

The good news is that we have time to assess how these policy initiatives progress once the president-elect takes office. We need to practice patience in rendering judgment about the financial market impacts of the election outcome given it is still unclear who is going to fill all key administration staff positions and what specific policies can and will be pursued. Yes, actions can be employed through executive order, but there are restrictions and limits to them; many key policy initiatives will require acts of Congress, and with very narrow GOP majorities in both chambers, there are no slam dunks regarding likely outcomes.

Suffice it to say for now that we, along with much of Wall Street, are pleased to see that Scott Bissent has been named as the nominee for secretary of Treasury. He has the rich bond market experience we need to deal with our ballooning deficit and the challenging structure of our federal debt. He should also act as a voice of reason in the room as debates on tariff policies take place throughout 2025 and 2026. As Walt Whitman (and Apple TV+ network character Ted Lasso, played by Jason Sudeikis) might say on this front: “Be curious, not judgmental.” More detail to follow regarding additional thoughts on tariff policy.

Too Much of a Good Thing?

Let’s revisit the question posed in the title of this month’s commentary: Are the returns we’ve seen this year too much of a good thing and over the top or are they deserved? First off, is it possible to have too much of a good thing in life in general or specifically in investing? As you see in this month’s quotes above, ancient Greek fabulist Aesop said absolutely—as a general rule, too much of a good thing is bad, according to him. The late, great actress Mae West clearly disagreed and said too much of a good thing can be wonderful. Many famous folks have opined on this topic. They include the likes of F. Scott Fitzgerald and Mark Twain, who each concluded that too much of certain things are bad, yet of others can be wonderful. Specifically, they put champagne and whiskey in this latter category!

In our case, it’s probably more appropriate to research the opinion of a famous investor on this topic, right? Warren Buffett has weighed in and apparently agrees with Mae West, at least when it relates to constructing portfolios of individual stocks. He has been quoted as saying, “Why not invest your assets in companies you really like? As Mae West said, ‘Too much of a good thing can be wonderful’.” On this point, we agree with Warren Buffett. When it comes to active management and selecting individual stocks to include in client portfolios, there’s no such thing as establishing a process that focuses too much on identifying wonderful companies. We use FVT (fundamental, valuation and technical metrics) analysis to do this, and we’re happy to be accused of trying too much and too hard to select companies that will generate the finest results through our process.

The Markets Advance on FVTs

The real question posed in the title is not related to selecting individual stocks, however. It is asking about the market overall. Has the S&P 500 index gone too far, too fast—or is this advance rational? In one word, our answer to this is “yes.” I’m not trying to be cute. A little bit of both is happening. Whether assessing our outlook for a stock at the individual company level or our outlook for the broader market at the overall index level, we thoroughly examine the FVTs of each. The fundamental and technical price trend metrics of this market remain very solid, if not stellar.

This 2024 advance has not been based simply on relief and the knowledge that the ugly election campaign would soon be behind us, or on hopes for a typical Santa Claus rally and embrace of the usual positive seasonal forces, or on euphoria about the Federal Reserve rate cut cavalry that seems to be on its way. This bull market has been persistent and largely been driven by positive fundamental trends throughout the year in economic growth, the healthy employment and associated consumer spending data, calming trends in inflation, relatively stable interest rates and solid credit market conditions.

To wit, real gross domestic product (GDP) growth was recently confirmed at 2.8% in the third quarter and is estimated by the Atlanta Federal Reserve Bank’s GDPNow tool to be 3.2% in the fourth quarter … far better than anticipated going into the year.5 S&P 500 earnings grew nearly 6% in the third quarter of 2024 over the same period in 2023, despite expectations for earnings to decline over the same period going into the quarter. Excluding energy, the earnings growth was 8%.6 Inflation continues to calm, and credit spreads remain tight. Technically, leadership has broadened as earnings contributions from stocks in the various sectors have also broadened. This cannot be characterized as a technology-only-driven market anymore. Conclusion: This advance is real and warranted based on the fundamental and technical data.

That said, the third metric we constantly monitor, valuation, is sending cautionary signals and is beginning to look rather full, with the S&P 500 price level of roughly 6,000 standing at almost 22 times expected 2025 calendar-year earnings. We do believe that a 22-times multiple can be maintained in a world in which earnings growth is double digit, profit margins are rising and inflation rates and yields are calming and stabilizing as they are. However, there is little margin for error. Rates need to hold relatively steady and profit margins need to stay healthy to achieve current earnings growth expectations and maintain current valuation multiples. We would not like to see price-to-earnings ratios (P/E’s) rise further to the 23- to 24-times level. That would be too much for us.

2025 Crystal Ball Preview: Fundamentals Remain Solid

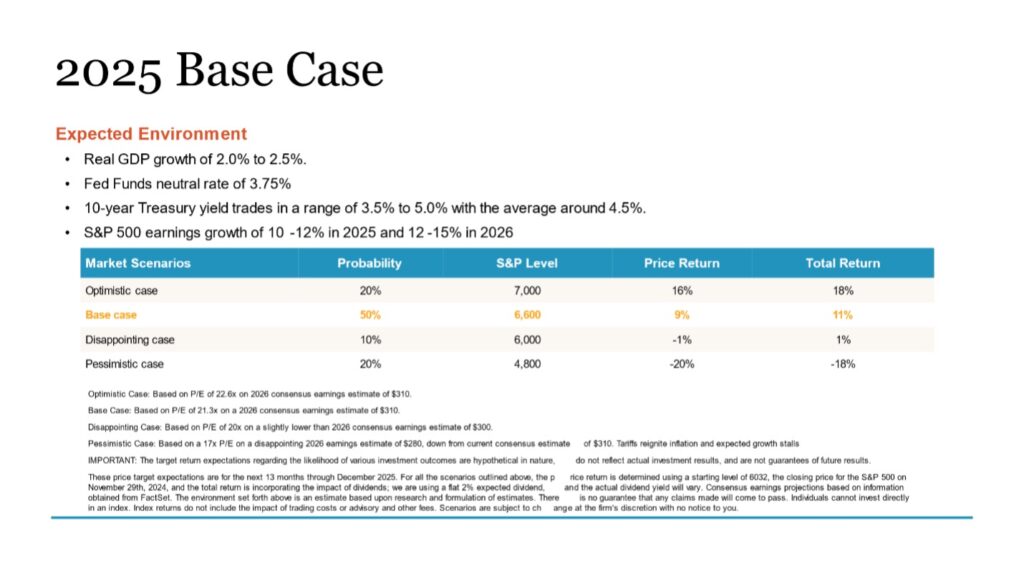

Current or even higher levels in the S&P 500 do not spell future meltdown or an ugly bear market to us. The fundamentals remain too solid to place a high probability on such a scenario. In fact, based on our expected economic, earnings growth and interest rate assumptions for 2025 at present, we are looking for an S&P 500 price target of 6,600 by Dec. 31, 2025, in our base case, and for a price level as high as 7,000 in our more optimistic scenario.

That being said, if we push to these levels sooner than we expect and prior to confirmation that earnings growth is playing out as anticipated, it would result in returns being front-end loaded and cap returns later in 2025. In our mind, returns that are too front-end loaded could also set the stage for larger temporary corrections and higher volatility should any of the key monthly economic (inflation, rates or activity) or earnings-related data points disappoint. We might end up in the same 2025 price destination when the dust settles, just in lumpier and more stress-inducing fashion.

A major difference in our Crystal Ball market outlook scenarios for 2025 versus prior years is that the range in outcomes is a bit broader and more volatile than we’ve presented in previous years. Because of higher fiscal policy risks and greater unknowns regarding their likely impact on the FVTs, the distance between upside versus downside price targets is larger than in past years. Katrina Radenberg, Mariner’s chief investment officer, and I look forward to reviewing our 2025 outlook and assumptions with you in detail during our 2025 Crystal Ball presentation on January 16!

What About Those Tariffs?

An additional brief discussion on tariffs is warranted as we close, given how headlines about tariffs are trumpeted daily and their controversial nature. No doubt, this is an issue to study. Unbeknownst to many, tariffs on China are already at the 30% level … 20% tariffs on China goods were employed back in 2018 under Trump, which Biden kept, and then President Biden added an incremental 10% tariff to get them to 30% at present.

The point here is that headline Trump tariff threats are not as much an incremental change as first meets the eye. Importantly, experts, such as Strategas’ political analyst Dan Clifton (rated as the top policy research team and top independent research analyst across all research verticals by a survey of institutional investors conducted by Institutional Investor magazine), believe that China is the key tariff risk, not Europe, Canada, Mexico and the rest of the world (ROW) that we all read about.

Per Clifton, the tariff powers that can be employed under executive orders (EO) emanate primarily from the International Emergency Economic Powers Act. Trump has standing to rationalize higher tariffs on China for “national security” purposes under EO, but he’ll be hard-pressed to make those same arguments in the case of most of the ROW and our allies. Broader tariffs on these other countries are likely to take congressional action, and, with both slim majorities as well as the makeup of the GOP caucus (that includes folks who don’t want to see rising inflation hit constituents in their districts), it is unlikely that we’ll see tariff legislation of sizable magnitude pass.

For example, Clifton believes the threatened 25% tariffs on Mexico are immigration policy-focused and a warning to Mexico to help clean up the border or “We will ruin your economy”—a negotiation ploy. It is speculated that Trump’s main motives in his tough tariff rhetoric prior to taking office are: 1) In the case of China, to incent U.S. companies to think about moving supply chain out of China and back to the U.S. sooner rather than later and 2) In the case of friends like Mexico, to keep Mexico on notice that it might behoove them to limit the drugs and a potential overwhelming flow of illegal immigrants from crossing the border prior to his inauguration.

Bottom line: It is premature to assume tariffs will be outrageous and worst case. Let’s chill on making premature judgments as to outcome or impact on tariff policy for now and remember that we have time to assess what might happen. Not unlike 2018!

Wrap-Up

Investors appear fairly giddy right now, but we still see upside in 2025 based on the data. We maintain a healthy base case. Please join us on January 16 for the Crystal Ball presentation where we will lay out the details.

Happy holidays!

Sources:

1-4FactSet

5Bureau of Economic Analysis and the Atlanta Federal Reserve Bank’s GDPNow

6FactSet

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. For specific information and definitions on the S&P 500 sector indices, please visit https://www.spglobal.com/spdji/en/landing/investment-themes/sectors/. Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The indexes referenced herein are unmanaged and cannot be directly invested in.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Investment advisory services are offered through Investment Adviser Representatives (“IARs”) registered with Mariner Independent Advisor Network (“MIAN”) or Mariner Platform Solutions (“MPS”), each an SEC registered investment adviser. These IARs generally have their own business entities with trade names, logos, and websites that they use in marketing the services they provide through the Firm. Such business entities are generally owned by one or more IARs of the Firm, not the Firm itself. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Registration of an investment adviser does not imply a certain level of skill or training.

Material prepared by MIAN and MPS.